If your answer is ‘yes’ for any of these questions, then, you’re in the right place.

In straightforward terms, an investment property is a real estate property that you buy with the aim of getting a return on investment—by way of the future resale of that investment property or rental income or both. It can be a short-term endeavour or a long-term venture.

If it’s a short-term investment, an investor often engages in the game plan of buying, remodelling, or renovating real estate, then selling it at a profit within a short time frame (also called 'renovate and flip').

For investors who go into it for the long term, they work out a strategy —usually from 5 years to almost 20 years in some cases. From there, they conduct due diligence to pinpoint the most profitable, highest and best use of a property.

For him, financial freedom meant contributing, adding value to people’s lives and being productive while also being able to be an intentional and present dad to his kids—especially during their formative childhood years.

He and his wife wanted to allow their children the chance to experience a life that they themselves didn’t have growing up, without spoiling them, of course.

Like I mentioned earlier, it can be pretty daunting for first-time investors.

I felt intimidated when I first started. But with the right mentors and by doing my due diligence, I was able to take the leap—and stay on this route for a while now. Since then, I’ve learned a lot and am still learning about investment property.

In my experience, I delved into what I determined was best for my situation and that is different for everyone.

But before I made any major decisions, I made sure I did the research and weighed the pros and cons.

This type of investment in vacant land and new developments offer a wealth of opportunity. You can customise the deal and build specifically for the market. However, you also need to recognise that you’re taking on more work in the process.

To make it easier for you to see the big picture, let’s look at the pros and cons of going into this type of investment property.

If after thoroughly considering all sides and deciding that this type of investment property is the best choice for you, then be ready to go all in.

You never know—you can be on the same path Nhan Nguyen once walked on.

Sometimes, you may find a property that seems perfect at first. However, if you discover that it’s not what the local market needs, that property can become a money sink.

On another note, if you take on a tenant, you also have the property management side of things to consider. Still, residential properties can prove profitable, assuming you know what to look for.

Again, let us look at the pros and cons of this one.

He actually bought his first property when he was just 21 years old and had to work three jobs to buy it. The second one he bought shortly after that was a residential property.

And that was when he discovered that he preferred investing in residential properties over commercial ones.

During my interview with him, he shared the advantage of having this type of investment property.

But of course, you have limitations when it comes to commercial properties.

When venturing into this type of investment property, you need to buy with a business in mind. And you must give a level of control over to your tenants.

After all, they need to turn the property into something that works for the business.

One of the people I know who like this type of investment property is Harry Charalambous.

He is a commercial property investor who owns a mixed-use property in St Ives as part of his whopping $20+ million portfolio.

He’s also one of the directors of Plan Assist Property Team. This team runs a business of giving property investors the help they may need to purchase properties. Plus, their business is also geared towards developing those with a focus on manufacturing equity in investments.

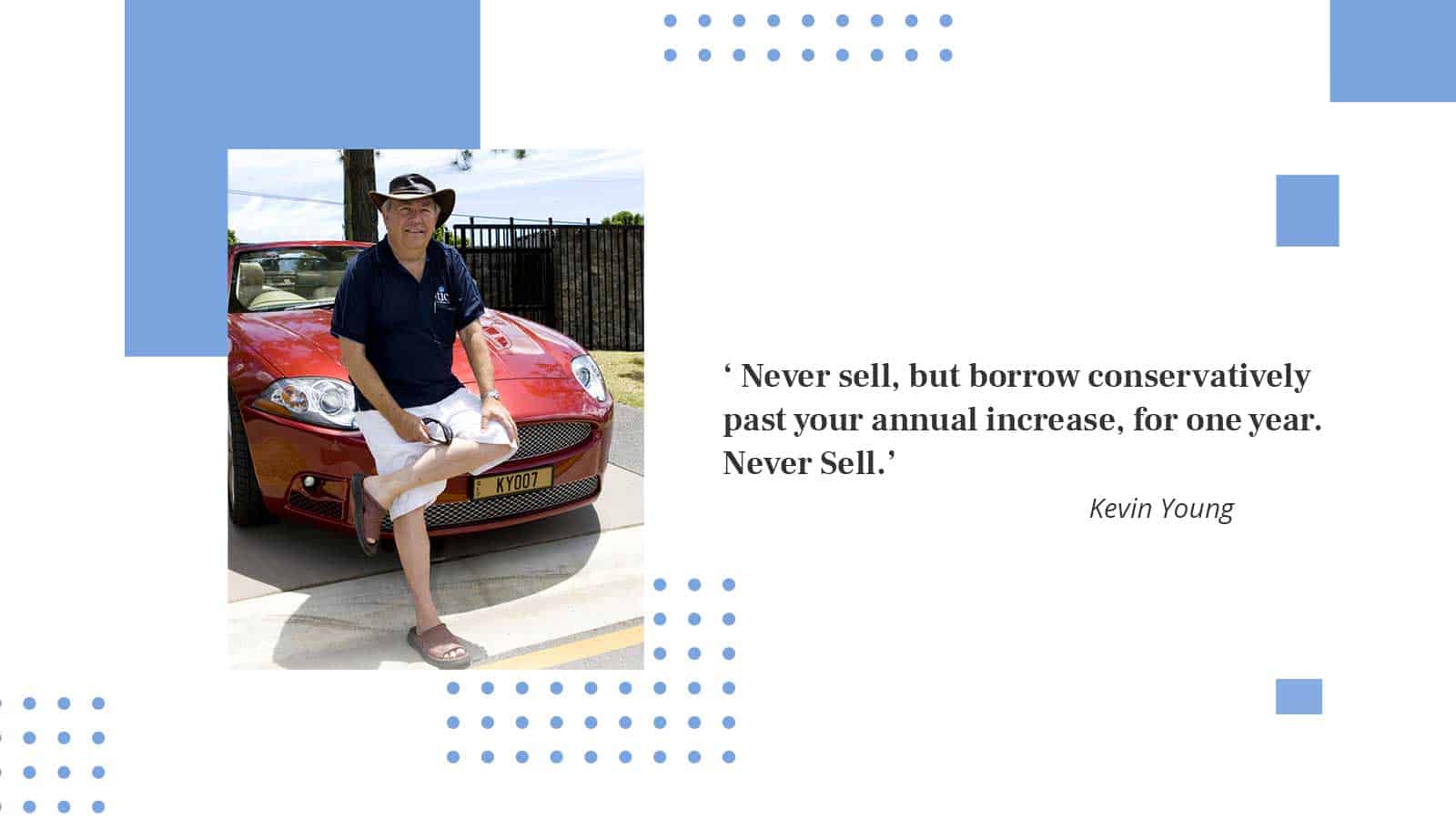

Like what I said earlier, it really starts with that one question when you venture into buying an investment property. And, whether young or old, every investor’s journey is unique.

For instance, I myself prefer investing in residential properties. It's always in high demand in the market because people will always need spaces to live in.

Once you’ve weighed your options, your challenge is to figure out which works best for you.

Then from there, you need to build a strategy around that type of investment property—and, naturally, you’ll need to find the ideal property for your portfolio. And that is where we come in.

We at Property Investory can recommend buyers agents to help you buy the type of investment property that your portfolio needs.